Next: The correlation of stock

Up: Methods

Previous: Methods

Contents

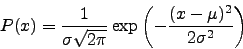

As we already said in the Introduction, some economists assume the returns to be Gaussian distributed, but we saw in Figure 1.3 that the tails of the distribution are ``fatter'' than a Gaussian distribution. To fit the Gaussian distribution we computed the mean ( ) and standard deviation (

) and standard deviation ( ) of the returns and plotted the probability distribution function:

) of the returns and plotted the probability distribution function:

|

(2.1) |

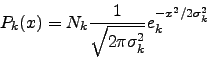

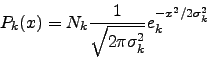

But we can fit distributions with fat tails, like the T-student or Tsallis distribution [61] to the distribution of returns and see if the tails are better fitted with this. The probability distribution function of a T-student is given as:

|

(2.2) |

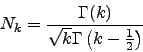

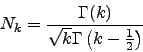

where  is a normalisation factor:

is a normalisation factor:

|

(2.3) |

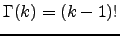

and

is the Gamma function. The factor

is the Gamma function. The factor

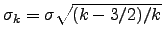

is related with the effective standard deviation of the distribution (

is related with the effective standard deviation of the distribution ( ) and with the degree of distribution (

) and with the degree of distribution ( ). The function

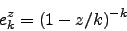

). The function  is an approximation of the exponential function called k-exponential:

is an approximation of the exponential function called k-exponential:

|

(2.4) |

and in the limit

this function reduces to the ordinary exponential function. The probability distribution function can be written as:

this function reduces to the ordinary exponential function. The probability distribution function can be written as:

![\begin{displaymath}

P_k(x) = \frac{\Gamma(k)}{\Gamma \left( k-\frac{1}{2}\right)...

...2 k -3)}} \left[1 + \frac{x^2}{\sigma^2 (2 k -3)} \right]^{-k}

\end{displaymath}](img121.png) |

(2.5) |

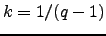

The parameter  is related with the Tsallis parameter

is related with the Tsallis parameter  by

by  . The computation of the parameters of T-student distribution is explained in Appendix A.

For all the stocks of the London Stock Exchange that we studied, the minimum value of

. The computation of the parameters of T-student distribution is explained in Appendix A.

For all the stocks of the London Stock Exchange that we studied, the minimum value of  is

is  and the maximum

and the maximum  , but most of the values are in the

, but most of the values are in the ![$[2, 4]$](img126.png) interval, which means values of

interval, which means values of  in the

in the ![$[1.25, 1.5]$](img127.png) interval, that is around the values found by Tsallis [62] (

interval, that is around the values found by Tsallis [62] ( ,

,  and

and  ) for

) for  ,

,  and

and  minutes return, respectively, for the NYSE in 2001. For example the value of

minutes return, respectively, for the NYSE in 2001. For example the value of  found for HSBC company is

found for HSBC company is  (the one used in the T-student distribution in Figure 1.3).

(the one used in the T-student distribution in Figure 1.3).

Our study is based on the assumption that the returns of the stock price carry more information than random noise. To check this, we will compute the correlation between returns of stock prices and analyse the correlation matrix. The main idea of our work is to find the underlying correlation matrix of stock returns.

Next: The correlation of stock

Up: Methods

Previous: Methods

Contents

Ricardo Coelho

2007-05-08

![]() ) and standard deviation (

) and standard deviation (![]() ) of the returns and plotted the probability distribution function:

) of the returns and plotted the probability distribution function:

![\begin{displaymath}

P_k(x) = \frac{\Gamma(k)}{\Gamma \left( k-\frac{1}{2}\right)...

...2 k -3)}} \left[1 + \frac{x^2}{\sigma^2 (2 k -3)} \right]^{-k}

\end{displaymath}](img121.png)